They say: “I am too busy to make an offer or even look right now.”

You say: “I am just curious, is there a way you can schedule your week so you can home search for two hours? I don’t want to see you lose the opportunity of the $8,000 tax credit and low interest rates.”

They say: “This home faces the wrong direction. I want more southern exposure.”

You say: “If this house faced south, would it be your new home?” (buyer response) “Good!” “Tomorrow we will only view southern exposure homes. Does 6:00 work for you?”

They say: “I don’t think the market has hit bottom.”

You say: “How will you know when we are at the bottom?” (buyer response) “The supply and demand ratio indicates that there are only _____ homes per buyer. This is a clear indicator of turn in the market.”

They say: “My hours may be cut, or worse yet, I may loose my job.”

You say: “Help me understand. What is the difference between your monthly rent payment and your qualifying payment for your new home?” (buyer response) “If I may ask, where do you plan on living if you lose your job?”

They say: “I do not know if I can get a loan.”

You say: “The two big steps in getting you into a home are meeting with a realtor and meeting with a lender. Would you be able to meet with our lender tomorrow during the day or in the evening?”

They say: “Something better might come on the market.”

You say: “What would make another home better?” (buyer response) “Are you willing to risk losing this home, the neighborhood, and the great price for a hope of greener grass?”

They say: “My credit score is low.”

You say: “I would think twenty minutes with our loan officer will clarify your concerns. Is Tuesday or Wednesday better for you to meet with our loan officer?”

They say: “I have a lease on my apartment.”

You say: “Have you explored the options for an early vacancy?”

They say: “I want to sleep on it.”

You say: “That sounds good. I will call the listing agent first thing in the morning to see if the home is still available and then I’ll call you. Do you have any questions on the property I can get answered for you?” (buyer response) “Do you have any other purchasing concerns I can assist you with?”

They say: “I have a home to sell.”

You say: “Have you established the value of your home?” (buyer response) “Would Monday or Tuesday work best for me to preview your home?”

They say: “I want to be closer to my workplace.”

You say: “Are there other factors that impact your location choice?”

They say: “I am too busy with wedding plans.”

You say: “Are you familiar with the home search process?” (buyer response) “What is your target date for being in your new home?”

They say: “Interest rates may go down more.”

You say: “What rate are you hoping to capture?” (buyer response) “Let’s look at the current rate and your dream rate and calculate the monthly payment difference. Are you willing to lose this beautiful home, location, and great price for _____ per month?”

They say: “We want to think it over.”

You say: “You’re right. This is a huge decision. However, I have to give you fair warning with as little pressure as possible. If you are ready to write an offer on this home, other buyers may also be ready to write. Being first to write will make a difference in negotiating the best possible price for you.” (buyer response) “Is there something specific holding you back? How can I assist you with your decision?”

They say: “I don’t want to sign a buyer contract.”

You say: “Ok. I will simply work with you as a customer rather than a client. I will assist you with gathering information so you can make informed decisions. However, you need to understand that with any home listed by my brokerage, I will be working in the seller’s best interest, as they have signed a contract with our brokerage for full representation. If you sign a buyer’s representation agreement, you are legally represented as well.”

Cute, Quick or Quip

When responding to objections, it is not a matter of being cute, quick or quip. Rather it is important to discover the circumstances or reasoning that caused the objection. In doing so, you clarify and reveal buyer motivation. The bottom line result is better service and satisfied clients.

Clarifying Buyer Motivation

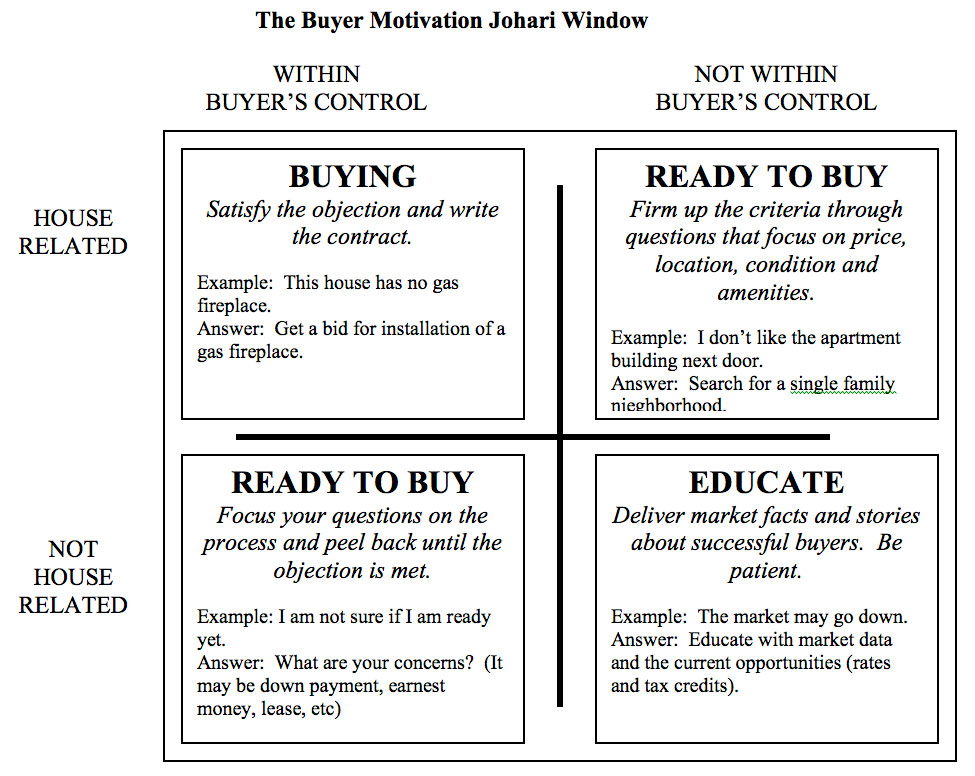

Use a two-step process for clarifying buyer motivation: The first step is to determine if the objection is house related or not house related. Step two is to determine if the objection is within the buyer’s control or not within the buyer’s control.

If an objection is house related and within a buyer’s control, this is person is buying. All you need to do is satisfy the objection and write the contract.

If an objection is neither house related nor within the buyer’s control, you have a long road of educating the buyer ahead of you. This buyer will need market facts, successful buyer stories and a lot of patience on your part.

The objection that is not house related but within the buyer’s control needs to be peeled back and indicates a buyer is ready to purchase. Peeling back the objection through concern and questions should reveal a missed step in the process or misunderstanding that the buyer has. For example, the buyer may not be sure about the purchasing range or how they proceed to buy the home.

On occasion an objection will surface that is house related but outside of the buyer’s control. This is also a buyer that is ready to purchase. To satisfy the objection you need to firm up the buyer’s criteria through questions that focus on price, condition, location and amenities.

The following Johari window will assist you in understanding the two step process I use for clarifying buyer motivation.